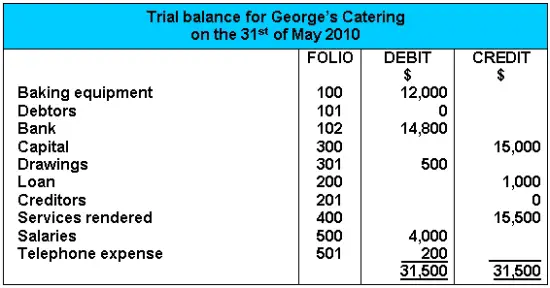

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. A trial balance lists the ending balance in each general ledger account. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. The debit and credit balances should be equal. The accounts reflected on a trial balance are related to all major accounting. Any discrepancy in the totals would signal the presence of a mathematical error in the accounting system. The Uses and Characteristics of Trial Balance-Keeping in mind the definition of the trial balance we can define the following characteristics and use of the trial balance-Trial balance is prepared in tabular form only. Though not a conclusive proof the agreement of the trial balance is a prima facie evidence of the absence of mathematical errors. These totals are entered in the debit and credit columns. Trial Balance aside from general ledger accounts is also useful to check the accuracy of special-purpose accounting books.

Moreover because the trial balances role is to make sure that total debits equal the total credits it doesnt mean the ledger is correct. Likewise there are many errors that trial balance cannot detect due to its limitations. To Detect and Correct Errors. These totals are entered in the debit and credit columns. It contains debit column for debit balance of accounts and credit column for credit balances of accounts. Accountants use a trial balance to test the equality of their debits and credits. Below is the summary of trial balance limitations. The total dollar amount of the debits and credits in each accounting entry are supposed to match. For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. The following are advantages and disadvantages of trial balance.

A trial balance can be used to compile financial statements which reveal the financial health of a business. The debits and credits include all business. It contains debit column for debit balance of accounts and credit column for credit balances of accounts. In this method ledger accounts are not balanced. For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. Trial Balance is the report of accounting in which ending balances of different general ledger of the company are available. A trial balance is a worksheet with two columns one for debits and one for credits that ensures a companys bookkeeping is mathematically correct. The Uses and Characteristics of Trial Balance-Keeping in mind the definition of the trial balance we can define the following characteristics and use of the trial balance-Trial balance is prepared in tabular form only. Therefore if the debit total and credit total on a trial balance do not match this indicates that. Though not a conclusive proof the agreement of the trial balance is a prima facie evidence of the absence of mathematical errors.

For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. In this method ledger accounts are not balanced. These totals are entered in the debit and credit columns. Though not a conclusive proof the agreement of the trial balance is a prima facie evidence of the absence of mathematical errors. Trial Balance is prepared to check the arithmetical accuracy of the postings of ledgers. It presents to the businessman a consolidated list of all ledger balances. If both the totals are not equal there must be some shortcomings in the postings made and hence rectification must be done. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. The Uses and Characteristics of Trial Balance-Keeping in mind the definition of the trial balance we can define the following characteristics and use of the trial balance-Trial balance is prepared in tabular form only. The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc.

Trial Balance is prepared to check the arithmetical accuracy of the postings of ledgers. Then when the accounting team corrects any errors found and makes adjustments to bring the financial statements into compliance with an accounting framework such as GAAP or IFRS the report is called the adjusted trial balance. For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. The debit and credit balances should be equal. Preparing and adjusting trial balances aid in the preparation of accurate financial statements. It means that the trial balance is used to check the parity between debit totals and credit totals. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. Types of Trial Balances When the trial balance is first printed it is called the unadjusted trial balance. Therefore if the debit total and credit total on a trial balance do not match this indicates that. Accountants use a trial balance to test the equality of their debits and credits.