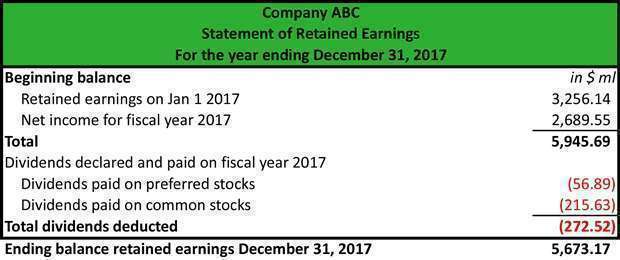

RE Beginning Period RE Net IncomeLoss Cash Dividends Stock Dividends. Where RE Retained Earnings. This statement defines the changes in retained earnings for that specific period. Retained earnings are calculated by adding the current years net profit if its a net loss then subtracting the current period net loss to or from the previous years retained earnings which is the current years retained earnings at the beginning and then subtracting dividends paid in the current year from the same. Company A has retained earnings of 10000 at the start of the year. In other words retained earnings are cumulative net income minus cumulative dividends paid to shareholders. Since net income is part of the retained earnings equation this fact is taken into account. Cash Dividend 5000. A balance sheet consists of assets liabilities and stockholder equity. Companies also maintain a summary report known as the statement of retained earnings.

Current Retained Earnings ProfitLoss Dividends Retained Earnings. 1200000 Beginning retained earnings 500000 Net income - 150000 Dividends 1550000 Ending retained earnings. How to calculate retained earnings. Earnings textBeginning Retained Earnings New. The statement of retained earnings provides helpful information to. Beginning retained earnings net income - dividends ending retained earnings. Terms Similar to the Retained Earnings Formula. Where RE Retained Earnings. What is the Statement of Retained Earnings. At the end of the current year the company has 1550000 of retained earnings on hand.

What is the Retained Earnings Formula. Retained earnings net income which as the name implies was not distributed among the participantsshareholders of the company. Retained earnings are calculated by adding the current years net profit if its a net loss then subtracting the current period net loss to or from the previous years retained earnings which is the current years retained earnings at the beginning and then subtracting dividends paid in the current year from the same. Terms Similar to the Retained Earnings Formula. As you can see in the retained earnings formula below one either adds the profit or subtracts the loss. Ad Get Our Collection of 1800 Business Legal Document Templates. So the calculation of Retained Earnings equation will be as follows. The retained earnings formula is also known as the retained earnings equation and the. Retained earnings equation The result from the sale andor provision of services may be positive or negative. The RE formula is as follows.

What is the Statement of Retained Earnings. Cash Dividend 5000. One important metric to monitor is the retained earnings calculation which is based on this formula. It is useful for understanding how management utilizes the profits generated by a business. The RE formula is as follows. The statement of retained earnings provides an overview of the changes in a companys retained earnings during a specific accounting cycle Accounting Cycle The accounting cycle is the holistic process of recording and processing all financial transactions of a company from when the transactionIt is structured as an equation such. In other words retained earnings are cumulative net income minus cumulative dividends paid to shareholders. Ad Get Our Collection of 1800 Business Legal Document Templates. Beginning retained earnings net income - dividends ending retained earnings. Its retained earnings calculation is.

Retained earnings are calculated by adding the current years net profit if its a net loss then subtracting the current period net loss to or from the previous years retained earnings which is the current years retained earnings at the beginning and then subtracting dividends paid in the current year from the same. What is the Retained Earnings Formula. The retained earnings formula is fairly straightforward. As you can see in the retained earnings formula below one either adds the profit or subtracts the loss. Do the Calculation of the Retained Earnings using the given financial statements. Since net income is part of the retained earnings equation this fact is taken into account. The statement of retained earnings reconciles changes in the retained earnings account during a reporting period. Let us consider an example to better understand how to calculate retained earnings. How to calculate retained earnings. Terms Similar to the Retained Earnings Formula.