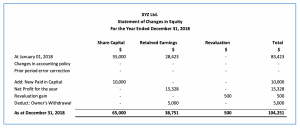

The statement of changes in equity is one of the main financial statements. A statement of changes in shareholders equity presents a summary of the changes in shareholders equity accounts over the reporting period. Heres the statement of changes in equity for Georges Catering from the previous lesson. Problem solving - use your acquired knowledge to solve for the ending equity balance given a set of figures. Below is a sample Statement of Changes in Equity with entries to show where the figures would be made. There are two types of changes in shareholders equity. Equity movements include the following. Analysis of the Equity Statement Hidden Losses and Off-Balance-Sheet Liabilities. IAS 1 set out the principles for presentation of Statement of Changes in Equity. It reflects all changes in equity between the beginning and the end of the accounting period arising from transactions such as new capital investment the dividend paid owners withdrawal net profit or loss and fixed assets.

The rest of the plant and machinery were purchased for cash. Posted by Nial Satis at 1931. Movement in shareholders equity over an accounting period comprises the following elements. Which of the following statements about the statement of changes in stockholders equity is true. Alternatively the net amount of Rs. B The statement of changes in stockholders equity reports changes in retained earnings but not changes in common stock. The purpose of the statement is to show the equity movements during the accounting period and to reconcile the beginning and ending equity balances. Ramco Cements presents the following information and you are required to calculate funds from operations. Below is a sample Statement of Changes in Equity with entries to show where the figures would be made. And this is how the balance sheet for Georges Catering would look.

There are two types of changes in shareholders equity. The purpose of the statement is to show the equity movements during the accounting period and to reconcile the beginning and ending equity balances. Indirect Method The indirect method uses changes in balance sheet accounts to reconcile net income to cash flows from operations. And this is how the balance sheet for Georges Catering would look. 39000 can be shown as application. If the company makes a loss then it is a retained loss for the year and is shown in brackets. V The equity shares were issued in exchange of machinery. Which of the following statements about the statement of changes in stockholders equity is true. Analysis of the Equity Statement Hidden Losses and Off-Balance-Sheet Liabilities. Posted by Nial Satis at 1931.

GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. It reconciles the opening balances of equity accounts with their closing balances. The answer is that we take the closing balance of the owners equity from the statement of changes in equity and put this in our balance sheet. Here is a compilation of top six accounting problems on fund flow statement with its relevant illustrations. There are two types of changes in shareholders equity. The statement of changes in equity is a financial statement showing the changes in a companys equity difference between assets and liabilities for a given period of time. Distribution of total comprehensive income during the year to various equity components and non-controlling interest. Ramco Cements presents the following information and you are required to calculate funds from operations. Statement of Changes in Working Capital. The purpose of the statement is to show the equity movements during the accounting period and to reconcile the beginning and ending equity balances.

The purpose of the statement is to show the equity movements during the accounting period and to reconcile the beginning and ending equity balances. Problem solving - use your acquired knowledge to solve for the ending equity balance given a set of figures. It is suitable for introductory financial accounting students. There are two types of changes in shareholders equity. Which of the following statements about the statement of changes in stockholders equity is true. The statement of changes in equity is one of the main financial statements. Distribution of total comprehensive income during the year to various equity components and non-controlling interest. Alternatively the net amount of Rs. The accounting for these expenses or lack of it leads to distortions. Assets Liabilities Stockholders Equity Cash Noncash Assets Liabilities SE Cash L SE NCA Cash L SE NCA This means that we can evaluate changes in cash by.