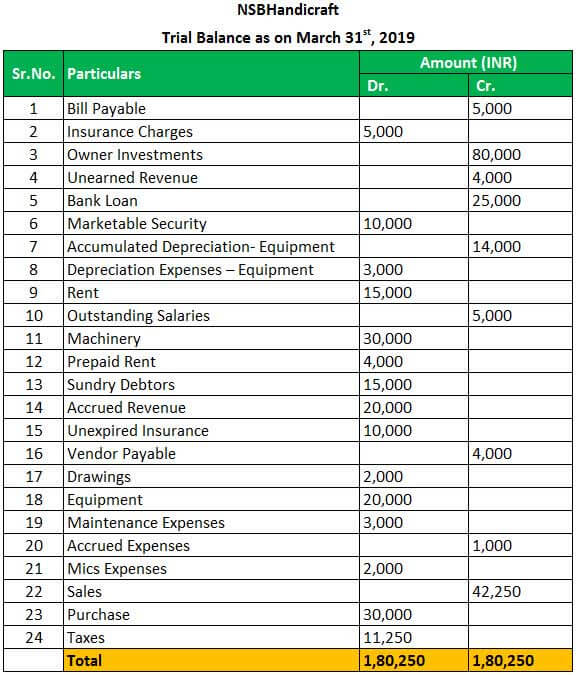

A trial balance is a list of all general ledger accounts and their balances at a point in time. The closing balance of the accounts are shown in trial balance on a particular date. Ledger balances are segregated into debit balances and credit balances. Gold Gems has reported the below transactions for the month of Feb 2019 and the accountant wants to prepare the trial balance for the month of Feb 2019. The zero items are not usually included. The final accounts are prepared with the help of the trial balance. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. In other words its a trial balance that is prepared at the end of the year to reflect the year-end adjustments. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. The accounts reflected on. The zero items are not usually included. The total dollar amount of the debits and credits in each accounting entry are supposed to match. What Is a Trial Balance. Trial Balance Example 2. Trial balance is the records of the entitys closing ledgers for a specific period of time. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. A trial balance lists the ending balance in each general ledger account. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading.

Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance. In other words its a trial balance that is prepared at the end of the year to reflect the year-end adjustments. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance. In essence its summary of all of the t-account balances in the ledger. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading. The closing balance of the accounts are shown in trial balance on a particular date. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc. An adjusted trial balance is a list of accounts and their balances at the end of an accounting period after the adjusting journal entries have been posted.

Selling of Finish product in. The closing balance of the accounts are shown in trial balance on a particular date. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. Most software accounting packages include a trial balance as part of their reports section and due to the software always posting a double entry the report will balance. In other words its a trial balance that is prepared at the end of the year to reflect the year-end adjustments. Brief description- Trial balance is periodical statement which is made on a particular date with the help of the ledger and cash books to check the arithmetical errors in the accounts. The purpose of a trial balance is to ensure that all entries made into an organizations general ledger are properly balanced. Trial balance is the steppingstone for preparing all the financial statements such as Trading and Profit loss account balance sheet etc. The zero items are not usually included. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc.

Trial balance is a bridge between accounting records and financial statements. What Does Trial Balance Mean. The final accounts are prepared with the help of the trial balance. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. Most software accounting packages include a trial balance as part of their reports section and due to the software always posting a double entry the report will balance. The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. The zero items are not usually included. The report is primarily used to ensure that the total of all debits equals the total of all credits. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc. In other words its a trial balance that is prepared at the end of the year to reflect the year-end adjustments.