To illustrate how to record adjusting entries to the trial balance assume that a corporation issues a one-year notes payable for 30000 with 8 percent interest. The size of the entry equals the accrued interest from the date of. A debit to Interest Expense and a credit to Cash for 500 b. Interest payable amounts are usually current liabilities and may also be referred to as accrued interest. Therefore it must record the following adjusting entry on December 31 2018 to recognize interest expense for 2 months ie for November and December 2018. These accrued expenses include accrued interest on notes payable in which the company needs to make journal entry by debiting interest expense account and crediting interest payable account. A debit to Cash and a credit to Interest Payable for 500 c. Interest of 500 has accrued on a note payable to the bank. Adjusting journal entry required to accrue interest on December 31 2018. In this case the company creates an adjusting entry by debiting interest expense and crediting interest payable.

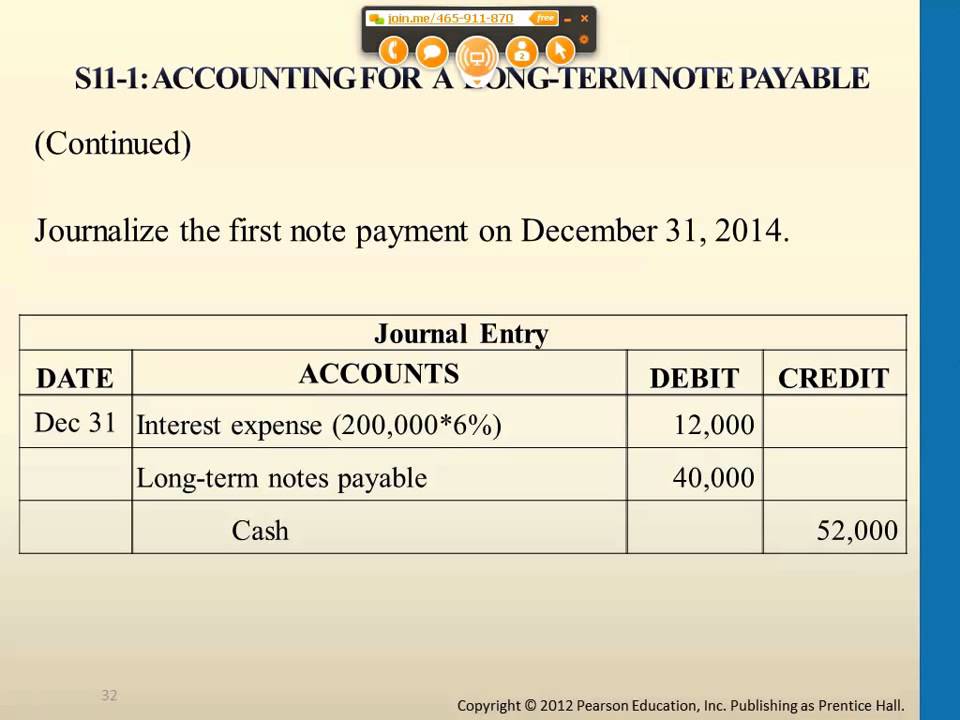

Decrease in assets and reduction in net. For example if a 36000 long-term note payable has a 10 percent interest. Prepare the following adjusting entries at August 31 for Walgreens. The adjusting entry to record this debt would be. At the period-end the company needs to recognize all accrued expenses that have incurred but not have been paid for yet. A Interest on notes payable of 300 is accrued. Therefore it must record the following adjusting entry on December 31 2018 to recognize interest expense for 2 months ie for November and December 2018. Interest of 500 has accrued on a note payable to the bank. Interest on notes payable of 400 is accrued. Interest is expected to be paid each December 31.

The bookkeeper for Juaquin Company asks you to prepare the following accrued adjusting entries at December 31. To record accrued interest on note at year end. Decrease in assets and reduction in net. In this case the company creates an adjusting entry by debiting interest expense and crediting interest payable. The adjusting journal entry for Interest Payable is. Interest Expense will be closed automatically at the end of each accounting year and will start the next accounting year with a. A Interest on notes payable of 300 is accrued. The company may incur interest costs because it has borrowed cash from a lender or has issued debt such as bonds notes or commercial paper. Interest payable amounts are usually current liabilities and may also be referred to as accrued interest. At period-end adjusting entry.

And if I go back up top and change the dates from 1012020 229 to zero and run that report close up the old hamburger you can see of course both sides of the transaction here one in the payable which is going to be a liability account up top and then down below. A debit to Interest Expense and a credit to Cash for 500 b. 100000 6 212. To illustrate how to record adjusting entries to the trial balance assume that a corporation issues a one-year notes payable for 30000 with 8 percent interest. The size of the entry equals the accrued interest from the date of. Interest on notes payable of 400 is accrued. B Services earned but unbilled total 1400. Notes Payable principal amount 10000. At the period-end the company needs to recognize all accrued expenses that have incurred but not have been paid for yet. Record the adjusting entry for interest.

Decrease in assets and reduction in net. Interest payable amounts are usually current liabilities and may also be referred to as accrued interest. At the end of each accounting period a business must record adjusting entries to acknowledge any interest it has accrued or accumulated over the period. These accrued expenses include accrued interest on notes payable in which the company needs to make journal entry by debiting interest expense account and crediting interest payable account. Interest of 500 has accrued on a note payable to the bank. The company may incur interest costs because it has borrowed cash from a lender or has issued debt such as bonds notes or commercial paper. Accrued interest expense on notes payable for January. The bookkeeper for Juaquin Company asks you to prepare the following accrued adjusting entries at December 31. B Services earned but unbilled total 1400. Adjusting journal entry required to accrue interest on December 31 2018.